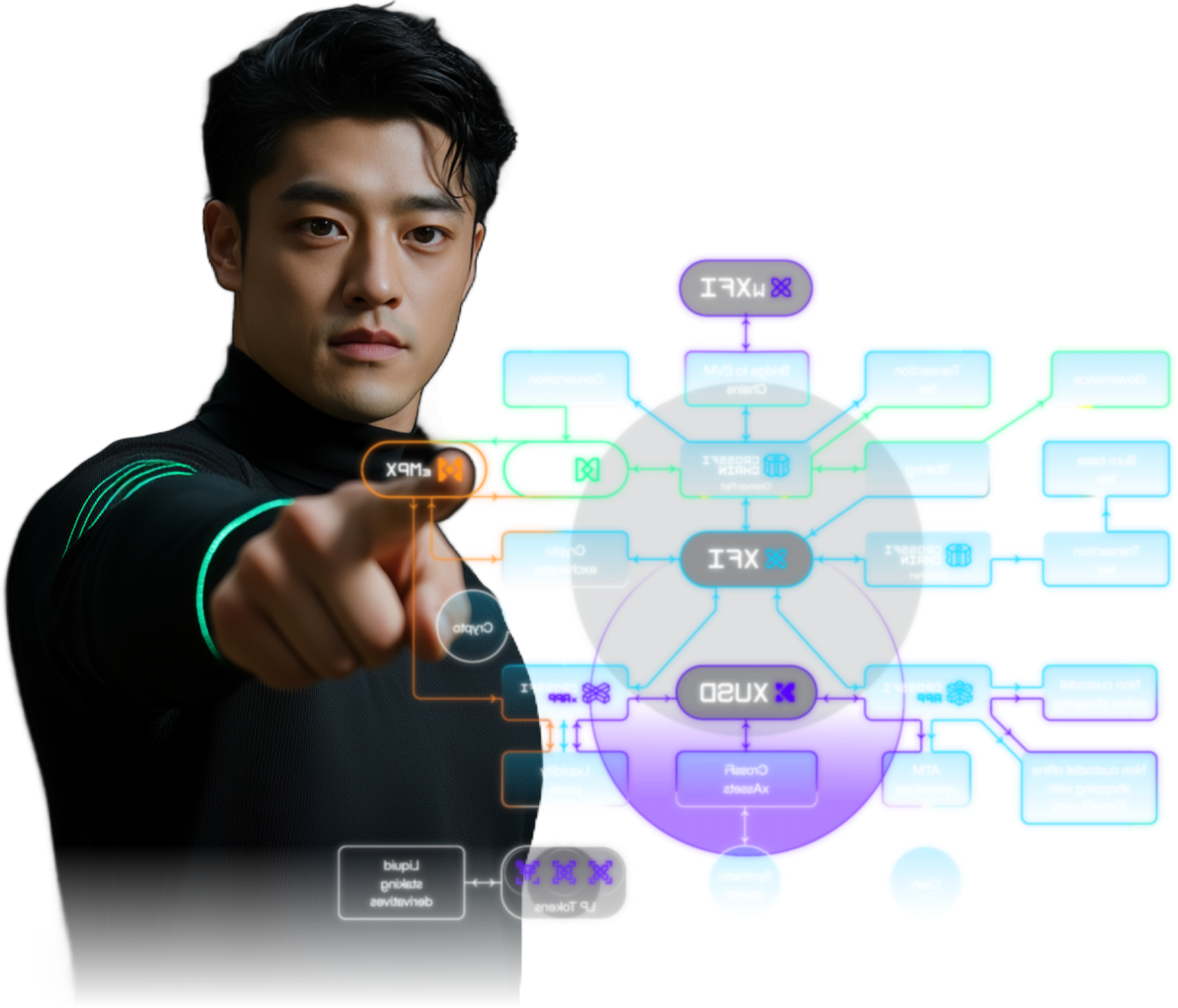

CrossFi is the innovative platform, that combines the security of Cosmos and the flexibility of EVM. Our mission is to grant access to the fair and reliable financial instruments for everyone, regardless of their location

Brings together the best of both WEB3 worlds

01

02

03

option a

XFI or USDT: Ensure you have either XFI or USDT in your MetaMask or another EVM-compatible wallet and purchase eMPX through the launchpad.

option b

Swap in xAPP: Log in to the xAPP and select the amount of XFI or USDT to swap to eMPX.

tokenomics empx

5-Year Token Distribution

Gradual emission

Tokens are issued gradually, avoiding sudden spikes in circulation supply.Planning horizon

A systematic approach to issuing tokens will extend it to several years (up to 5 years), ensuring predictable dynamics of supply on the market. Lock periods and delayed vesting starts.Lock periods and delayed starts

Allow early investors and the team to display long-term commitment, reducing the risks of instant selling.What is eMPX?

eMPX is a derivative token of the CrossFi ecosystem, which connects the value of the MPX staking token to the flexibility of the EVM protocols. eMPX allows users to take advantage of staking MPX, participate in liquidity pools and use advanced DeFi features.

What makes eMPX unique?

Limited emission: maximum volume of 400 million tokens. Liquidity support: participating in eMPX/USD and eMPX/USDT liquidity pools. Lockup period: eMPX checks provide price stability, preventing speculation. Tokenomics transparency: deliberate issuing and distribution mechanics.

What are the benefits of holding eMPX?

Participation in liquidity pools and profiting from trading fees. Staking and DEX trading capabilities (coming soon). Protection from volatility provided through stable tokenomics. Direct access to the CrossFi ecosystem via xAPP.

How can I purchase eMPX?

There are two ways to purchase eMPX: via xAPP: Use XFI or USDT to trade for eMPX. via liquidity pools: Purchase eMPX using eMPX/XUSD or eMPX/USDT pairs, bypassing the lockup period.

What are the eMPX "checks"?

Cheques are temporary obligations used to receive eMPX, they're issued on tokens purchase. After a 2-week lockup period you will be able to exchange them for eMPX via xAPP. This framework stabilises the price and reduces speculative activity.

How does the lockup period work?

The lockup period starts immediately after the eMPX purchase. You receive cheques that can be exchanged for eMPX in 2 weeks. This helps avoid instantaneous token-to-market dumping and maintains a balance of supply and demand.

How can I use eMPX?

Liquidity pools: Participate in eMPX/XUSD or eMPX/USDT pairs and profit from trading fees. Decentralized exchanges: Trade eMPX on DEX (after the listing). DeFi-protocols: Use eMPX in cutting-edge decentralized protocols.

How do you support the liquidity of eMPX?

The liquidity is secured through eMPX/XUSD and XUSD/XFI pools. It allows users to purchase and sell the tokens anytime without intermediaries. Liquidity is also supported by a dedicated market-making fund.

How are eMPX and MPX related?

eMPX is a derivative token based on MPX. It reflects the value of the MPX but also provides more flexibility by supporting EVM protocols such as DeFi, liquidity pools, and decentralized exchanges.

What is the tokenomics of eMPX?

Total volume: 400 million tokens. Initial circulation: 18.9 million tokens (~4.73%). Main categories for distribution: Investors: 34%, Team: 10%, Liquidity: 12.5%, Marketing: 10%, Reserve fund: 17%. Unlocking: gradual, with the addition of lockup and vesting, extended to 5 years.

Why is eMPX valuable for a DeFi user?

Direct access to the CrossFi ecosystem. Participation in liquidity pools and profiting from fees. A potential for long-term growth caused by the limited emission. Ease of use, provided via xAPP and MetaMask.

What risks does eMPX have?

Dependency on XFI exchange rate and on XUSD stability. Possible volatility on the early stages of trading. Complexity of the framework for new users, unfamiliar with CrossFi.

How can you make money with eMPX?

Liquidity: participate in liquidity pools and earn from fees. LP tokens staking: earn extra income. Trading: Use arbitrage capabilities and the rate dynamics. Early access: Join in at the initial stages to make use of growth advantages.

What's next for eMPX?

Listing on DEX and CEX for open trading. Integration with the new DeFi protocols. The expansion of the CrossFi ecosystem and the token's demand increase. New partnerships and new use capabilities.